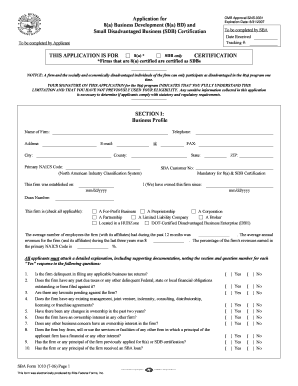

Get the free sba form 1010c

Get, Create, Make and Sign

Editing sba form 1010c online

How to fill out sba form 1010c

How to fill out SBA form 1010C:

Who needs SBA form 1010C:

Video instructions and help with filling out and completing sba form 1010c

Instructions and Help about sba form 1010c download

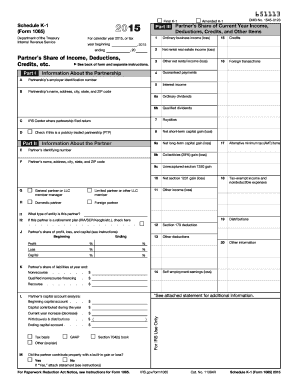

The question I'm not going to answer the question that I'm going to answer today is how to complete the personal financial statement correctly this is a common question because the personal financial statement is often completed incorrectly causing delays and even loan declines, so I'm going to answer this in two videos first video is going to show you how to complete the personal financial statement correctly which will save you time and headache the second video is going to show you how the bank will interpret your personal financial statement which will help you identify the strengths and weaknesses of your personal financial statement, and you'll be able to make some adjustments hopefully prior to submission of your personal financial statement personal financial statements also called the PFS just the acronym for it okay so couple quick things you only have one time to give your first impression so let's do it right, so the personal financial statement is a personal document to reflect you and your spouse's financial situation not your businesses not any third parties your uncle's financial information any money they're going to give you etcetera it is to reflect you and your spouse the form that we're going to go over today is called the SBA form 4:13 this is issued by the SBA, and it is required if you are completing an SBA loan and if you're not doing an SBA loan it's a good form to know most banks use it anyway and if you have one of their personal financial statements you can typically just sign their form and then use this one instead okay so let's get started up in the top right here you are going to see expiration date the first thing you want to make sure is that the form is current this one expires September 2014 below that you're going to see an as of date this is where you are going to put the date as all this information is based on I suggest let's pretend today is July 15th, so I would have you print off all of your documents your bank statements your credit card statements your mortgage statements your car loans every financial doubt your stock certain stock information all of those documents as of 6:30, so you want to do go back to the previous month and print off all your documents ending with the last day of the month, so I would put 6:30 up here if it was 7:15 today okay down towards the first third of the second third of the page you're going to see name this is for you and your spouse's name the rule is this if you file a tax return joint then both of those names are to be listed on the personal financial statement just because your spouse is listed does not mean that he or she is a guarantor on the loan, but it does represent that you two own assets together okay residents address is below that I recommend putting wherever you live currently that's usually your personal or primary residence however it could be an apartment, or you could be wherever you're living currently below that is business name and applicant name...

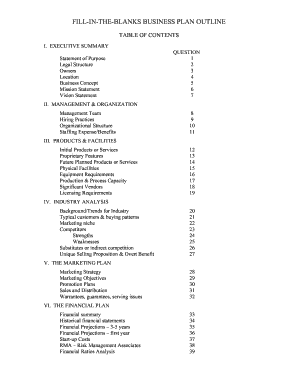

Fill sba form 1010c business plan templste : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your sba form 1010c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.